income tax rate philippines 2021

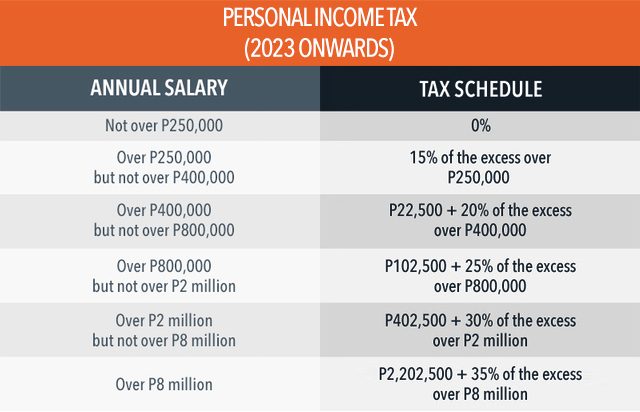

Philippines Residents Income Tax Tables in 2024. Philippines Residents Income Tax Tables in 2021.

How To Compute Income Tax Of Mixed Income Earner Train Law Youtube

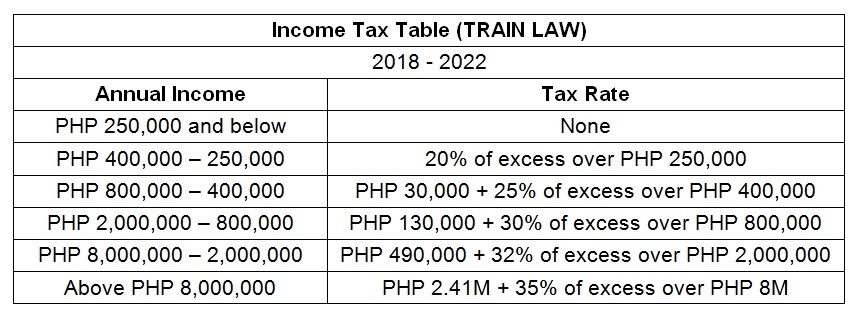

Income Tax Rates and Thresholds Annual Tax Rate.

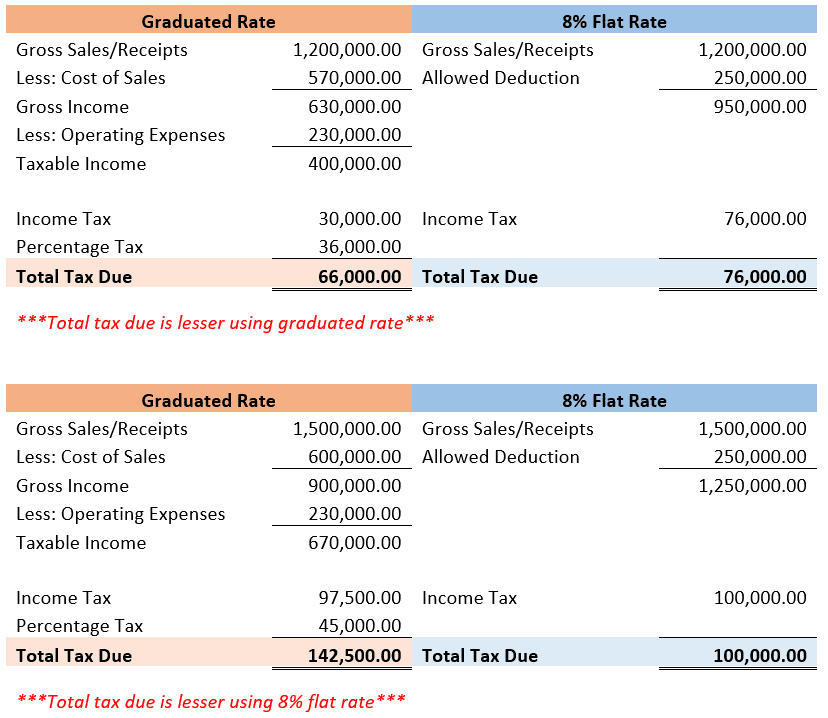

. Generally its the amount of income thats taxable unless exempted by law. Choose a specific income tax year to see the Philippines income tax rates and personal allowances used in the associated income tax calculator for the same tax year. 8 tax on gross salesreceipts and other non-operating income in excess of PHP 250000 in lieu of the graduated income tax rates and percentage tax business tax or.

Implements the new Income Tax rates on the regular income of corporations on certain passive incomes including additional allowable deductions. Php 840000 x 040 Php 336000. To get the taxable income subtract the OSD from the gross.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates. The latest comprehensive information for - Philippines Personal Income Tax Rate - including latest news historical data table charts and more. 11534 Corporate Recovery and Tax Incentives for Enterprises.

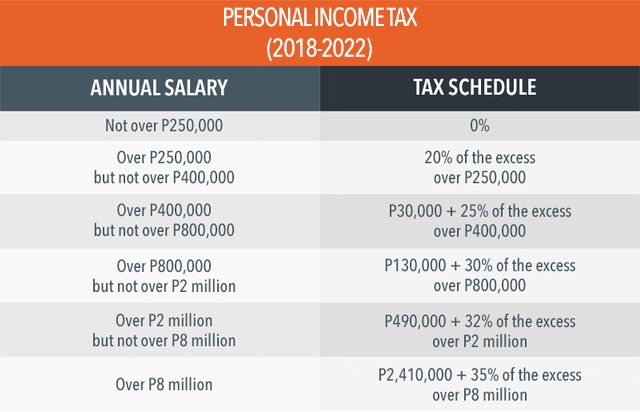

With the new tax reform middle and low income earners will be exempted from income tax. The compensation income tax system in The Philippines is a progressive tax system. Philippines Highlights 2021.

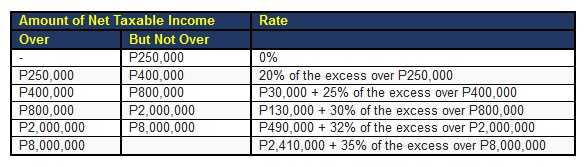

Up to PHP 250000 0 PHP 250001 PHP 400000 20. 35 rows April 8 2021. The Philippine President signed into law the proposed Corporate Recovery and Tax Incentives for Enterprises CREATE Act on 26 March 2021 1 but vetoed several provisions.

This is done by. Determine the standard deduction by multiplying the gross income by 40. Compliance for corporations.

Personal Income Tax Rate in Philippines averaged 3253 percent from 2004 until 2020 reaching an all time high of 35. Social taxes consist of contributions to the Social Security System. The Personal Income Tax Rate in Philippines stands at 35 percent.

The maximum annual social tax payable by a foreign national employee is PHP 32700 for tax year 2022. The Personal Income Tax Rate in Philippines stands at 35 percent. Implements the provisions on Value-Added Tax VAT and Percentage Tax under RA No.

Personal Income Tax Rate in Philippines averaged 3253 percent from 2004 until 2020 reaching an all time high of 35. Income Tax Rates and Thresholds Annual Tax Rate. Individual income tax rate Taxable income Rate.

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Graduated Income Tax Or 8 Special Tax Which Is Better Accountableph

Comparison For Income Tax Rates Graduated It Rates Vs 8 It Rate

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

How To Compute The Income Tax Due Under The Train Law Cpa Davao Accounting Tax Business

Us New York Implements New Tax Rates Kpmg Global

What Are Itemized Deductions And Who Claims Them Tax Policy Center

How To Compute The Income Tax Due Under The Train Law Cpa Davao Accounting Tax Business

How To Calculate Foreigner S Income Tax In China China Admissions

Graduated Income Tax Or 8 Special Tax Which Is Better Accountableph

How Is Taxable Income Calculated How To Calculate Tax Liability

Tax Calculator Compute Your New Income Tax

Tax Calculator Compute Your New Income Tax

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Thailand S New Personal Income Tax Structure Comes Into Effect Asean Business News

Taxable Income Formula Examples How To Calculate Taxable Income